Investors renewed interests were witnessed last week in the equities market on the Nigerian Stock Exchange, NSE. This may be sustained this week amid expected half year corporate results. Since companies are expected to start turning in their half-year result from this week, it is expected that many investors will take positions on the stocks at favourable prices. Stocks to watch this week is selected from the gainers and losers of the previous week, as well as those having corporate actions. Corporate actions include dividend payments, closure of registers, and qualification dates.

Stocks with controversies surrounding them or results released after trading hours also make our stocks to watch list.

Unity Bank Plc

Unity Bank Plc was the biggest gainer last week, hence its place on our watch list. The stock has traded in a volatile manner in the last few months. Rising upon the announcement of a proposed $1 billion investment by a private equity firm, Milost Global, then falling after the agreement was aborted.

Unity Bank closed Friday at N0.97 and is trading at a PE ratio of 9.39 times earnings.

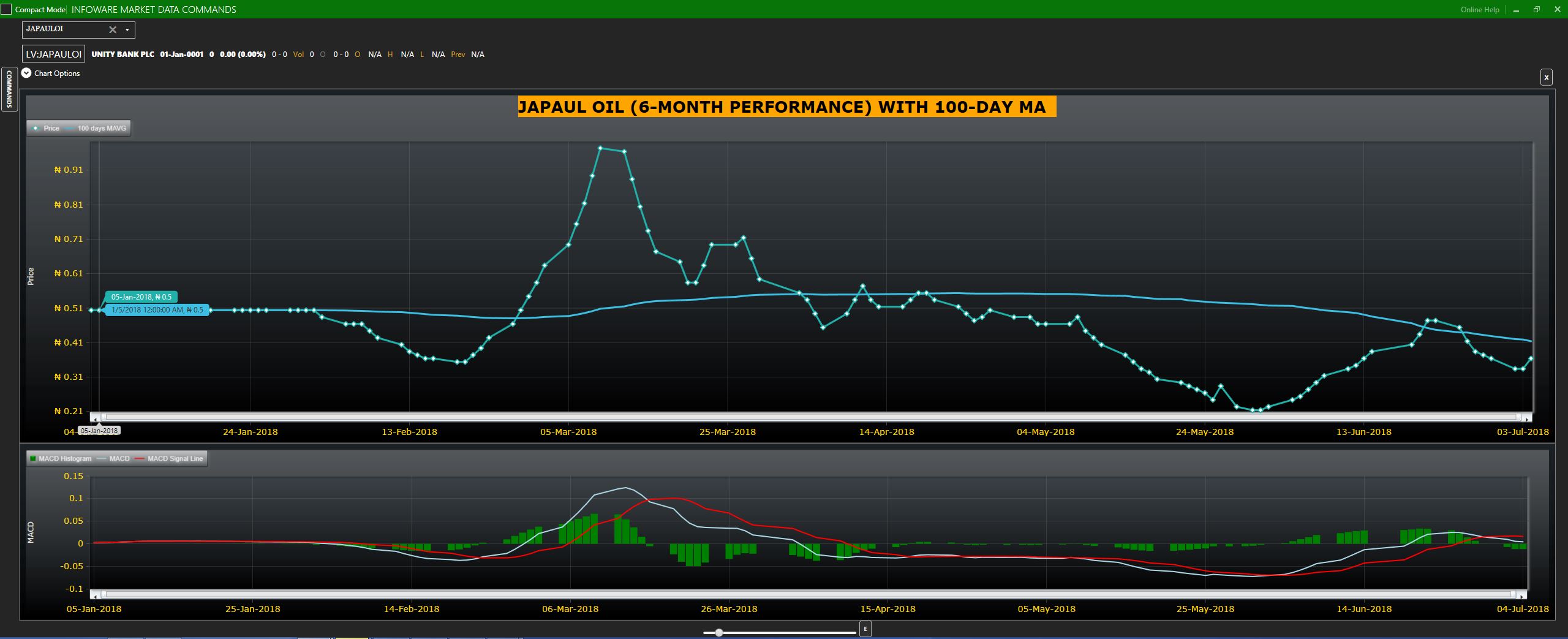

Japaul Oil and Maritime Plc

Japaul was the biggest loser last week shedding 23.40%. Japaul’s price has also traded in a zigzag manner, following an agreement with Milost Global to inject $350 million into the firm, and the termination of the said agreement.

Japaul closed at N0.36 on Friday’s trading session.

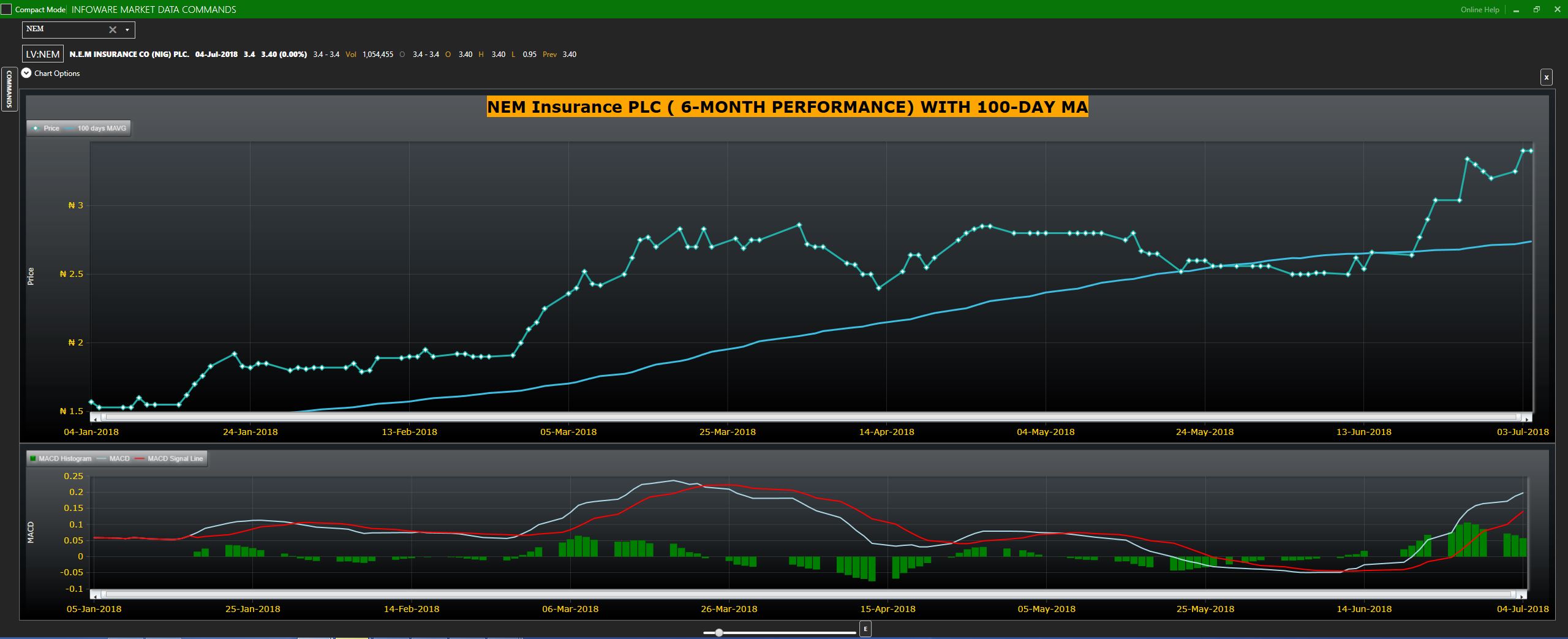

NEM Insurance Plc

NEM Insurance was in the news last week due to a proposed private placement. Shareholders gave the go-ahead for the company to raise N2.64 billion through a private placement. This will see the company issue about 1,056,000,000 ordinary shares of 50 kobos each, at N2.50.

NEM closed Friday’s trading session on the Nigerian Stock Exchange (NSE) at N3.04 and a PE ratio of 6 times earnings.

Flour Mills of Nigeria Plc

Flour Mills makes watch lists by virtue of releasing its full-year 2018 results after trading hours.

Revenue increased from N524 billion in 2017 to N542 billion in 2018. Profit before tax jumped from N10.4 billion in 2017 to N16.5 billion in 2018. Profit after tax also increased from N8.8 billion in 2017 to N13.6 billion in 2018.

Flour Mills closed Friday’s trading session at N32, and at a PE ratio of 6.68 times earnings.

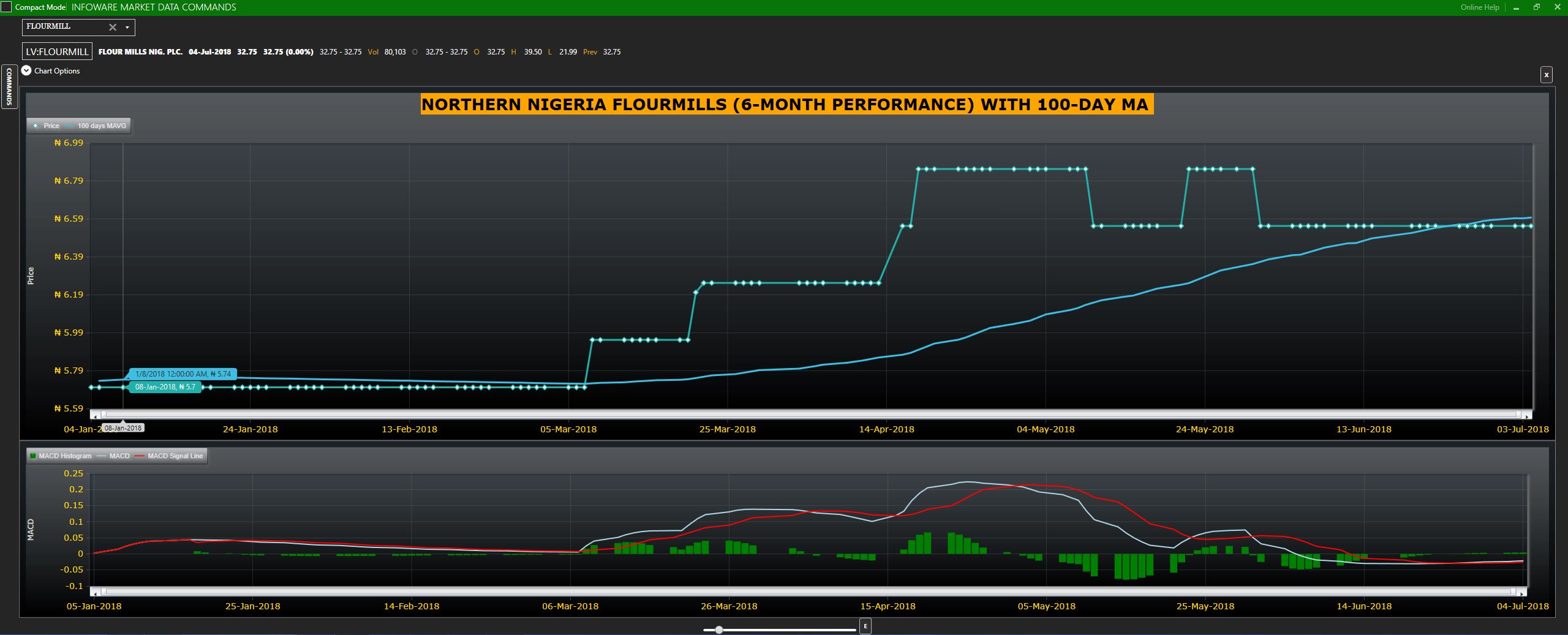

Northern Nigeria Flour Mills (NNFM)

NNFM is into the milling of maize, sorghum, and wheat. It is a subsidiary of Flour Mills of Nigeria Plc, which holds 53.06% of the company’s equity.NNFM gets a spot on our watch list by virtue of releasing its results after trading hours. The company closed at N6.65 on Friday’s trading session.

LASACO Assurance Plc

LASACO Assurance will be paying a dividend of N0.03 on July 5, 2018. This is for the 2017 financial year.

LASACO closed at N0.36 on Friday’s trading session and is trading at a PE ratio of 3.99 times earnings.

11 Plc (formerly Mobil Oil Plc)

11 (pronounced double one) Plc will be paying a dividend of N8 per share for the 2017 financial year. The stock closed at N183 on Friday’s trading session and at a PE ratio of 6.57 times earnings.

All the images are gotten from the InfoWARE Market Data Terminal, follow this link to enjoy a one-month free trial ( https://infowarelimited.com/infoware-product-contact-page/ )

Read more at: ( https://www.vanguardngr.com/2018/07/equities-market-rebound-persist-amidst-expected-half-year-earnings/ )