|

InfoWARE

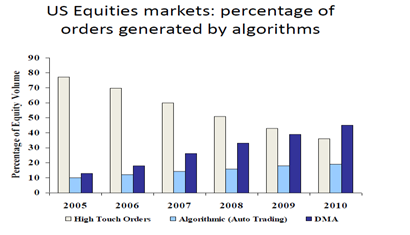

Picture This: “ Mr. Ade Oghene is the Head of Equity trading at one of the most prestigious Stock Broking firms in Nigeria. Their clientele range from Institutional clients to Hedge fund managers who transact businesses worth billions of Naira. He waltzed into his trading room recently only to see the Chief Dealing Officer leaning back in his chair reading Trader magazine, cross-legged while sipping coffee. It was the middle of the trading day ”. “ Trading void? Do you need something to do?” “ I’ve got the algos working. I could go high-frequency, if you want.” “ No, that’s OK. Keep up the good work.” Smartass trader. I suppose I had that one coming, though. The trading landscape certainly has changed over the past 5 years. The Nigerian Stock Exchange with broker-dealers, buy-side funds, exchanges and venues of trade execution as its primary players, is experiencing a historical transformation. This enormous change is being driven by deep underlying factors shaping global market today including:

Institutional clients need to trade large amounts of stocks. These amounts are often larger than what the market can absorb without impacting the price. The buy-side is increasingly searching for solutions to lower transaction cost and enhance quality of their executions which are being more closely monitored and scrutinized. On the sell side, large firms are looking to outsource their trading desk to increase their capacity to execute more volume. Major brokerage houses are franchising their computer trading strategies to smaller firms while small and mid-size broker dealers are not adequately equipped with resources to handle this volume. Thus, the need for Algorithmic trading Algorithmic trading or Black Box trading offers a less expensive option to full service brokers, while providing a way to complete a complex order type. Algorithmic trading refers to any form of automated rule-based trading where decision-making is delegated to a computer model.

The key development is the increasing use by the sell side of algorithms to execute their business as an alternative to the traditional route. Typically this type of algorithm is designed to target a trading benchmark: for instance VWAP(Volume Weighted Average Price), implementation shortfall or market-on-close.

In its simplest definition, Algo trading is the ideal strategy for successful traders/professionals who needs to invest or trade, and do so successfully. Some of the benefits of Algorithm Trading as shown from industry studies:

Algorithm trading will enable “Both” sides to focus on execution. For the buy side, execution cost will become transparent. For the sell side, the profitability of both their overall trading departments and of individual accounts will be measurable. The sell side will respond to this by reallocating resources towards profitable activities and relationships. If you have made it thus far, InfoWARE Algo Trader is around the corner! Our Differentiating Factor:

InfoWARE Algo Trader uses superior technology and flexible back office operations to provide a wide range of services designed to meet your specific trading needs. We are constantly evolving and expanding our technology and services to meet the unique algo trading needs of our clients while providing unmatched technology support.

|

For more information

|